Why Automating Property Tax Bills Is A Pre-Requisite For Your Business

Automating Property Tax Bills:-Are you still relying on a manual system to effectively process your property tax bills? If so not only does it mean your system is not as efficient or effective as it could be, but you are also putting your business in a disadvantaged position.

How?

1. It costs more: While there isn’t an exact figure for the cost of manual invoices, various experts, like Sterling Commerce, have found that the average cost of a paper invoice can range anywhere between $12 to $30. However, companies with a more complex AP process can expect costs to peak at nearly $40 per invoice. Sterling states that fully-automated invoices cost just $3.50 per invoice to process.

2. It’s time-consuming: With a manual system, it takes days or even weeks to process bills. As your team spends more time on such non-essential activities, more important activities such as analysing and reducing assessments are impacted.

3. It’s prone to human error: Excel spreadsheets and other manual tax tools are prone to human error, and you may be doubling your risk by using different systems for tax payments and tracking deadlines. There is often no way to trace mistakes, which leads to more wasted time, effort, and if penalized, money.

4. It makes compliance tracking difficult: The jurisdictional standards of compliance are varied, which may get strenuous to keep track of, especially if you are processing large volumes of tax bills across numerous states and counties. A lack of compliance could mean the loss of property or incurring additional interest and penalty costs.

5. It adds to discrepancies: Missing bills become much more difficult to identify and track as you may have to go through scores of records to determine bills that are expected but not received.

6. Duplication: Duplication of work becomes a large drawback as every bill needs to be reviewed for accuracy. Automation cancels the need for this, while avoiding costly data errors and enabling timely filing and payments.

7. Managing Documents: Hard copies of tax bills need to be kept which requires maintenance and storage space.

Why automation with Property Tax Plus

Property Tax Plus has years of experience and expertise in technologies to automate processing of property tax bills and offers the following benefits

Why automation with Lowest Cost per Bill with Maximum Data AccuracyTax Plus

Property Tax Plus uses an exhaustive data extraction and validation process by combining in-house developed Artificial Intelligent algorithms, text analysis scripts and, and domain experts’ review to ensure complete accuracy of data extracted from property tax bills. We also set up rules in our process to incorporate nuances from each jurisdiction for each client to make sure the bills are processed to meet all specific requirements.

PTP provides the most comprehensive automation solution for Property Tax bills at the lowest cost per bill!

Centralized Management of Property Tax Bills

Property Tax Plus offers a web-based online portal that gives you 24-7 access to upload, track or export property tax bills. Scanned copies of paper bills can be zipped and uploaded into our cloud system within minutes and you can track the progress of each bill in real time, search archives of all bills and download bill information in excel or csv formats.

PTP provides system calendars, integrated approval workflows and ability to manage exceptions in the system!

Seamless Integration

Property Tax Plus builds an automated integration using direct FTP transfers with your Property Tax System or Accounts Payable system so that the processed bills can be approved and processed for payment. As bills are processed, they are scheduled for export based on their actual due date.

Analytics Platform

Property Tax Plus advance Analytics and Reporting platform helps you make informed decisions in a fast-changing environment where data is continuously getting collected. Get access to standard reports such as taxes per month, by jurisdiction, etc. or create your own reports using easy to use drag-n-drop feature and selecting a range of reporting options including pivot tables, bar charts or summary tables.

Share or download reports in different formats!

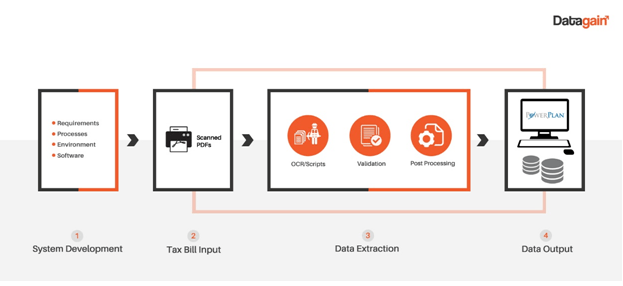

How It Works

1. We do a onetime set up of the process and integration with your existing property tax system or AP system

2. Files are uploaded to your secure online portal

3. We process each bill using specific rules and extract the data

4. Extracted data is exported to your AP system using automated transfers