In today’s dynamic business landscape, Fortune 500 Class 1 Railroad Companies are increasingly turning to advanced technology solutions to optimize their property tax management processes. This in-depth case study explores how a leading railroad harnessed the power of Property Tax Plus, a cutting-edge property tax management platform, to revolutionize its operations. By focusing on automated bill data extraction, integrated approvals, intelligent alerts and resolutions, seamless data integration with AP systems, and comprehensive tax management capabilities, this railroad achieved remarkable results while setting new standards for efficiency and compliance.

Challenges

- Manual Data Extraction: The railroad industry grappled with the labor-intensive task of manually extracting data from over 100,000 bills annually, leading to errors and inefficiencies.

- Approval Bottlenecks: The absence of integrated approval workflows caused delays in the payment process, impacting operational efficiency.

- Compliance Risks: Managing property, income, and franchise taxes across multiple jurisdictions posed significant compliance challenges, exposing the railroad to penalties and audit risks.

- Cash Flow Optimization: Limited visibility into upcoming tax payments hindered the railroad's ability to optimize cash flows and mitigate financial risks.

- Project Management: Coordinating property tax management activities across different departments and locations required meticulous project management and support.

Solution:

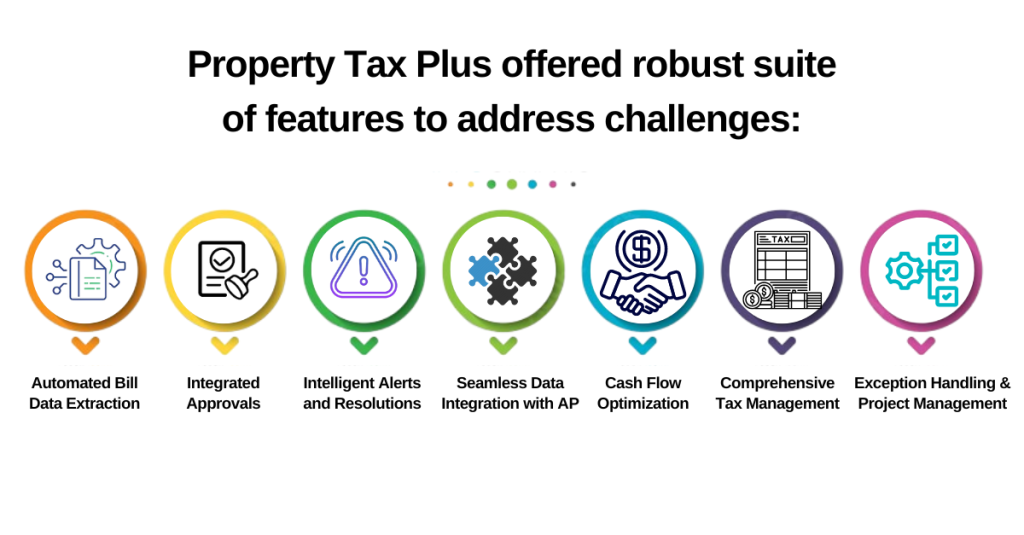

Property Tax Plus emerged as the property tax solution of choice for the railroad, offering a robust suite of features tailored to address its unique challenges

- Automated Bill Data Extraction: Leveraging state-of-the-art OCR technology, Property Tax Plus automated the tax data extraction from invoices and bills with unparalleled accuracy, eliminating manual errors and accelerating processing times.

- Integrated Approvals: The platform facilitated seamless approval workflows, allowing stakeholders to review and approve payments within a centralized system, thereby streamlining decision-making processes.

- Intelligent Alerts and Resolutions: Property Tax Plus provided real-time alerts for impending deadlines, discounts, and penalties, while offering intelligent resolution suggestions to proactively mitigate compliance risks

- Seamless Data Integration with AP: By seamlessly integrating with the railroad's AP systems, Property Tax Plus enabled automatic reconciliation of payments, reducing manual effort and ensuring data accuracy.

- Comprehensive Tax Management: Property Tax Plus supported the management of property, income, and franchise taxes across diverse jurisdictions, offering a unified view of tax liabilities and obligations.

- Cash Flow Optimization: Advanced forecasting and alerting functionalities empowered the railroad companies to optimize cash flows by providing visibility into upcoming tax payments and installment options, thereby minimizing financial risks.

- Exception Handling and Project Management: Property Tax Plus's robust alerting and exception handling capabilities facilitated timely resolution of discrepancies, ensuring data accuracy and compliance.

Moreover, dedicated project management support ensured a smooth implementation and ongoing maintenance of property tax solutions.

Results

- Efficiency Gains: The automation of bill tax data extraction and approval workflows resulted in a staggering 60% reduction in processing time, enabling tax teams to allocate resources to value-added activities.

- Cost Savings: By streamlining processes and reducing manual intervention, the railroad companies realized 60% cost savings, further bolstering its bottom line.

- Compliance Assurance: Intelligent alerts and proactive resolution suggestions bolstered compliance with tax deadlines and regulations, minimizing penalties and audit exposure.

- Cash Flow Optimization: Enhanced visibility into upcoming tax payments and installment options enabled the railroad companies to optimize cash flows, reducing the impact of penalties and interest charges.

- Exception Handling: Property Tax Plus has alerting and exception handling capabilities that facilitated timely resolution of discrepancies, ensuring data accuracy in property tax consulting and compliance, while dedicated project management support ensured a smooth implementation and ongoing maintenance of the solution.

Conclusion

By embracing property tax automation and leveraging the advanced capabilities of Property Tax Plus, the Fortune 500 Class 1 Railroad companies achieved 99% accuracy, unprecedented efficiency, massive cost savings, and compliance assurance in its property tax management processes. This case study underscores the transformative impact of cutting-edge technology solutions in navigating the complexities of tax management and driving operational excellence in the railroad industry. As railroads continue to evolve in a rapidly changing landscape, adopting innovative solutions like Property Tax Plus will be crucial in staying ahead of the curve and unlocking new opportunities for growth and success.

Case Study

Tax bill automation for one of the largest production companies

Property Tax Plus automated the property tax bill management for Texas energy bills.

Forecasting for a leading midstream provider

Property Tax Plus implemented a comprehensive forecasting models for multiple states and companies.

State and Local compliance for upstream, midstream and downstream

Property Tax Plus delivered a comprehensive reporting management system.